Central Texas Title Loans offer quick and accessible funding secured against vehicles, ideal for unexpected expenses, purchasing boats, or improving living situations. These loans provide flexible terms, faster approval times, and no credit check compared to traditional bank loans. By focusing on collateral value, they're accessible to a broader range of individuals, empowering them to manage debt effectively while preserving cash flow for essential costs.

Planning for a secure financial future can be a daunting task, but with Central Texas title loans, it becomes a strategic opportunity. This comprehensive guide explores what these unique loan services entail and how they can empower borrowers. From understanding the intricacies of Central Texas title loans to uncovering their diverse benefits and learning smart planning strategies, this article equips readers with knowledge to make informed decisions, ensuring financial stability and growth.

- Understanding Central Texas Title Loans: A Comprehensive Overview

- Benefits and Use Cases: Maximizing Your Loan Potential

- Smart Planning Strategies: Securing Your Financial Future

Understanding Central Texas Title Loans: A Comprehensive Overview

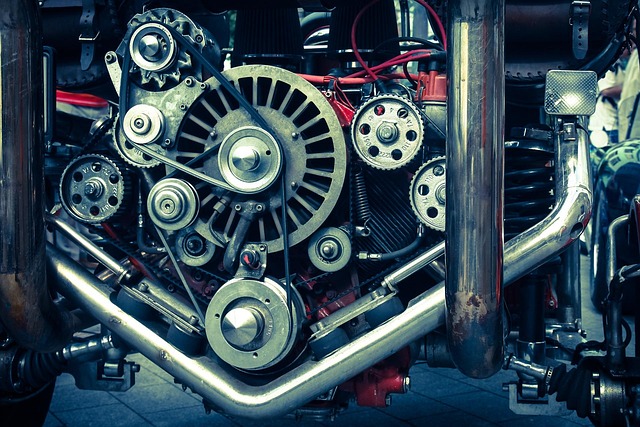

Central Texas Title Loans offer a unique financial solution for individuals seeking quick and accessible funding. This type of loan is secured against a person’s vehicle, providing an alternative to traditional bank loans, especially for those with limited credit options or poor credit scores. The process involves using the title of your vehicle as collateral, allowing lenders to provide more flexible terms and faster approval times compared to other loan types.

These loans are ideal for various purposes, from funding unexpected expenses to purchasing a new boat ( Boat Title Loans) or even improving one’s living situation. With Central Texas Title Loans, borrowers can gain access to substantial funds while retaining the use of their vehicle. Moreover, unlike Bad Credit Loans that often come with stringent requirements, Central Texas Title Loans focus on the value of the collateral rather than strict credit checks, making them accessible to a broader range of individuals.

Benefits and Use Cases: Maximizing Your Loan Potential

Central Texas title loans offer a unique opportunity for individuals seeking quick access to capital, providing several significant benefits that can be leveraged for diverse financial needs. One of the primary advantages is their ability to serve as a reliable source of emergency funds when unexpected expenses arise. Whether it’s a sudden medical emergency or a car repair, these loans can provide the necessary liquidity to cover immediate costs without the lengthy wait times associated with traditional banking options.

Moreover, Central Texas title loans are known for their flexible payment structures, allowing borrowers to tailor repayment terms to align with their financial capabilities. This feature is particularly beneficial for San Antonio Loans, enabling individuals to manage their debt effectively while preserving cash flow for other essential expenses. By strategically utilizing these loans, individuals can maximize their loan potential, ensuring that they receive the most value for their collateral and navigate through financial challenges with greater ease.

Smart Planning Strategies: Securing Your Financial Future

In the quest for secure financial planning, Central Texas title loans offer a unique and innovative approach. These loans, unlike traditional financing options, often come with benefits like no credit check requirements, making them accessible to a broader range of individuals. By leveraging the value of your vehicle, you can gain immediate access to funds, enabling smart planning strategies for your financial future.

The process is streamlined with online applications that save time and effort. With same-day funding, you’re not just securing a loan; you’re taking control of your financial trajectory. Whether it’s an unexpected expense or a strategic investment, Central Texas title loans provide a flexible solution. This modern approach to financing allows you to focus on long-term stability while keeping short-term needs in check.

Planning for your financial future doesn’t have to be a daunting task. By understanding the intricacies of Central Texas title loans and employing smart planning strategies, you can maximize their potential benefits. This comprehensive guide has equipped you with the knowledge to make informed decisions, ensuring a secure and prosperous financial journey ahead. Explore the possibilities with Central Texas title loans and take control of your monetary destiny.